Unemployment

The occupied population figures grew in October, too. The official unemployment rate, that is calculated on the active population only, decreased to 5.8% on a y-on-y basis. The more general figure, on the total population, remained steady at 7.1% and preliminary data for November indicate as well a 7.1%. The other, less bright side of the coin is that unfortunately, the new jobs are mainly concentrated in the lower tier of non-skilled labour, with low salaries. They are positions with below average pay, mainly in manufacturing either cheap or labour-intensive goods for export. Nevertheless, they seem not to be just seasonal jobs, but instead with strong expectations of becoming long-term jobs. In addition, considering the level of unemployment in Europe, a low-paid job is certainly better than nothing. Unfortunately though for many, especially in the less developed and more logistically difficult areas of the country, it is still more convenient to survive on welfare than work far from home for a meager pay. Unless policymakers implement some positive developments on the territorial mobility, this paradox will remain unresolved.

The occupied population figures grew in October, too. The official unemployment rate, that is calculated on the active population only, decreased to 5.8% on a y-on-y basis. The more general figure, on the total population, remained steady at 7.1% and preliminary data for November indicate as well a 7.1%. The other, less bright side of the coin is that unfortunately, the new jobs are mainly concentrated in the lower tier of non-skilled labour, with low salaries. They are positions with below average pay, mainly in manufacturing either cheap or labour-intensive goods for export. Nevertheless, they seem not to be just seasonal jobs, but instead with strong expectations of becoming long-term jobs. In addition, considering the level of unemployment in Europe, a low-paid job is certainly better than nothing. Unfortunately though for many, especially in the less developed and more logistically difficult areas of the country, it is still more convenient to survive on welfare than work far from home for a meager pay. Unless policymakers implement some positive developments on the territorial mobility, this paradox will remain unresolved.

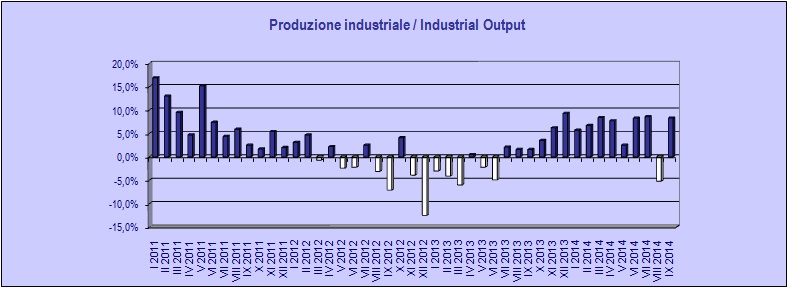

Industrial production

In October industrial production grew, but less than expected, according to some analysts. The figure is actually very good, +3.2% y-on-y. Especially if compared to the meagre 0.6% of the EU area. As usual, the trailer of the automotive sector is prevalent, which grew by 9.9% y-on-y. Almost all major players currently show a very positive sentiment for the end of year season, and industrial orders are growing by 8.3%. There is also a slight improvement in industrial job creation and salaries, which might even bring some breath to the domestic demand; it is as usual the Achille’s heel of the Czech economy and the industrial sector itself: as a matter of fact the industrial production dedicated to domestic demand was once again stagnating in October, with zero growth. This is clearly a heavy problem, which unfortunately is being ignored by the authorities. They tend to focus exclusively on fostering exports, thanks to artificial currency devaluation and real salaries compression, all detrimental to Czech families and consumers.

In October industrial production grew, but less than expected, according to some analysts. The figure is actually very good, +3.2% y-on-y. Especially if compared to the meagre 0.6% of the EU area. As usual, the trailer of the automotive sector is prevalent, which grew by 9.9% y-on-y. Almost all major players currently show a very positive sentiment for the end of year season, and industrial orders are growing by 8.3%. There is also a slight improvement in industrial job creation and salaries, which might even bring some breath to the domestic demand; it is as usual the Achille’s heel of the Czech economy and the industrial sector itself: as a matter of fact the industrial production dedicated to domestic demand was once again stagnating in October, with zero growth. This is clearly a heavy problem, which unfortunately is being ignored by the authorities. They tend to focus exclusively on fostering exports, thanks to artificial currency devaluation and real salaries compression, all detrimental to Czech families and consumers.

Inflation

Very bad news on the inflation front. The actual deflationary state keeps getting heavier, to the detriment of families and benefit only of few large exporters. Domestic demand is still very weak, therefore there is no room for a healthy moderate price increase on the domestic market. Unfortunately the ideological and short-sighted EU policies keep depressing the real economy, discouraging investments in such a cold market. In November the prices decreased on a monthly basis by 0.2%, into a dangerous deflationary spiral, and on a y-on-y CPI of 0.6%. Keeping into account the Crown devaluation during the last 12 months, the situation is quite dire. Families are getting poorer in real terms, prices are depressed and with them the attractiveness of the domestic market. A route that suggests the country is deemed to become a mere reservoir of cheap labour for products made for Europe’s northern rich countries.

Very bad news on the inflation front. The actual deflationary state keeps getting heavier, to the detriment of families and benefit only of few large exporters. Domestic demand is still very weak, therefore there is no room for a healthy moderate price increase on the domestic market. Unfortunately the ideological and short-sighted EU policies keep depressing the real economy, discouraging investments in such a cold market. In November the prices decreased on a monthly basis by 0.2%, into a dangerous deflationary spiral, and on a y-on-y CPI of 0.6%. Keeping into account the Crown devaluation during the last 12 months, the situation is quite dire. Families are getting poorer in real terms, prices are depressed and with them the attractiveness of the domestic market. A route that suggests the country is deemed to become a mere reservoir of cheap labour for products made for Europe’s northern rich countries.

Foreign trade

The Czech trade balance keeps posting strong figures. In October the surplus grew by nominal 1.7bn CZK on a y-on-y basis, recording a total surplus of 10.2bn. The figures are inflated by the CZK devaluation of course, and the real performance is less brilliant, yet still very strong. Especially towards the EU area, where the surplus is by 52bn CZK, a very bright figure. The trade deficit with Asia has increased. This is due in good measure to the strengthening of the dollars vs the Czech Crown, which more than compensated the major fall of oil prices. Once again, we see how exports are vital for the Czech economy. Therefore, each intervention or decision by the Central Bank of the Government – being it an independent decision of forced by the EU – is pragmatically aimed at fostering and subsidizing exports. The consequence is the impoverishment of the domestic markets and the Czech families, which in the end are subsidizing exporters compressing their own power of purchase, sometimes in dramatic fashion as was in 2014.

The Czech trade balance keeps posting strong figures. In October the surplus grew by nominal 1.7bn CZK on a y-on-y basis, recording a total surplus of 10.2bn. The figures are inflated by the CZK devaluation of course, and the real performance is less brilliant, yet still very strong. Especially towards the EU area, where the surplus is by 52bn CZK, a very bright figure. The trade deficit with Asia has increased. This is due in good measure to the strengthening of the dollars vs the Czech Crown, which more than compensated the major fall of oil prices. Once again, we see how exports are vital for the Czech economy. Therefore, each intervention or decision by the Central Bank of the Government – being it an independent decision of forced by the EU – is pragmatically aimed at fostering and subsidizing exports. The consequence is the impoverishment of the domestic markets and the Czech families, which in the end are subsidizing exporters compressing their own power of purchase, sometimes in dramatic fashion as was in 2014.

by Gianluca Zago