Unemployment

Unemployment level keeps steady at around 7.0%, which is the lowest level of the last few years. Some factors helped reaching this figure, not all of them of structural nature, such as seasonal jobs. Good hope comes from pick up in industrial production and the general positive outlook for the winter months. Unfortunately, there are strong signals for a jobless recovery, though. Some areas are experiencing an even deeper than usual occupational crisis, especially the Ostrava region, where after the elections it is expected a strong wave of layoffs, in the coal and steel industries.

As usual the situation is very different in Prague, where there is basically zero unemployment. But then again, the weakest regions keep being that. And they shall continue being weak, considering the all too generous subsidies to the unemployed and the negative attitude to relocation among the job-seekers.

Industrial Output

Nice recovery signals from the Czech industrial sector. In August there was an increase in production of about 1.6%, on a y-on-y basis. Most of all, the orders portfolio grew by 12.3%. It is true that late summer is always strong, for several reasons often independent on the general health of the economy, nevertheless the expectations for the coming months are eventually positive. Furthermore the EU area ongoing recovery, albeit mild, gives a positive outlook for the Czech industry, being EU its main export area. Also, access to purchase financing is quite cheap, with mortgage rates almost at record low: usually this translates into stronger demand for industrial products, such as cars and household appliances.

Inflation

The CPI index of price inflation keeps dropping. In September it reached the lowest level in three and a half years, at 1.0%. After the coming elections, it is reasonable to expect a loosening of public spending, and measures shall probably be taken to foster the domestic demand, its weakness being the key factor for the low inflation. It is not necessarily a positive sign, to only have a low inflation, if there is a weak domestic demand and no investments into industrial production. We saw in the last few years, that the drop in domestic demand wasn’t due to inflation, but to erosion of income and to deterioration of the job market.

Nevertheless, a very low level of inflation helps the Central Bank in keeping very low interest rates, and in trying to lower the Crown value to exports.

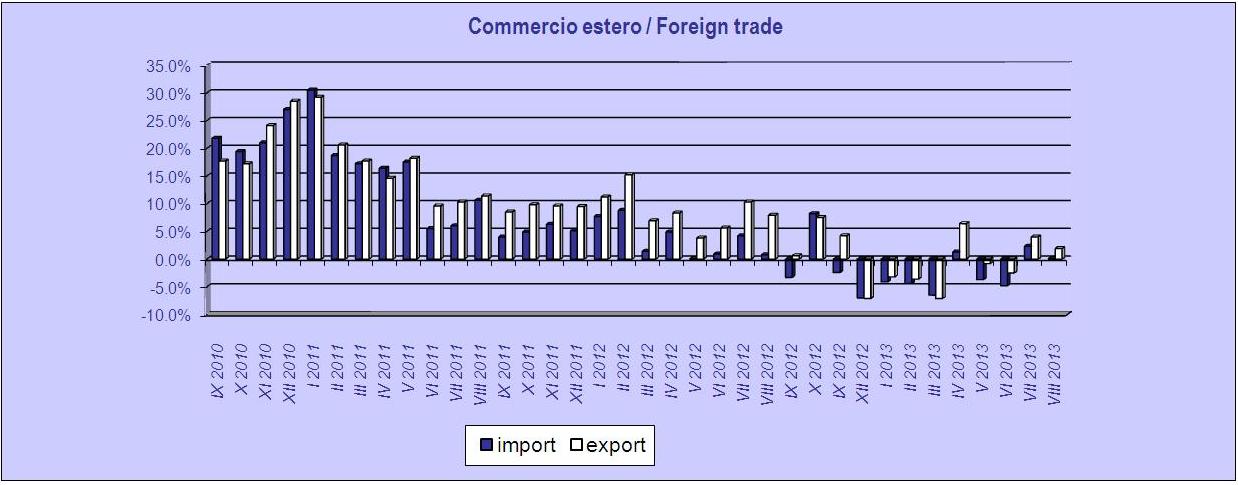

Foreign Trade

As usual, the trade balance was in positive territory also in August, by a nice 20bn Crowns, growing from last year by about 4bn. Exports are strongly growing again, after a temporary step back, by 1.9% with a nice outlook, considering the pick up in industrial production orders and the ongoing recovery of the EU area. Imports kept their level steady. We must note that the constantly positive trade balance is the key for the healthier state of the Czech economy, when compared to the Eurozone. That actually is the definitive argument against the Euro currency adoption. That moment seems quite far ahead in time. A very significant figure is the improvement of the trade deficit with China, lowered by 3.3bn Crowns. It is a key indicator in identifying positive signals for a revamp of local manufacturing. As usual, the balance with EU zone is positive by 51bn, that too a positive signal for the local manufacturing.

by Gianluca Zago