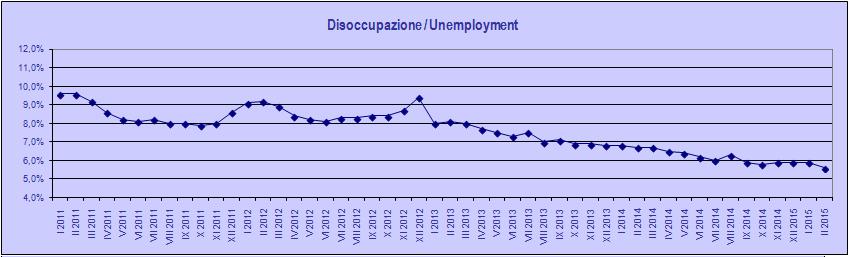

Unemployment

In February the unemployment rate decreased slightly, by 0.1%, to 6.5% of the active population. Those figures must be taken in cum grano salis : population is getting older on average. Therefore we have more people getting out of the active segment, than in. Figures then look artificially better. The reality is that there are more retired people and less payments into the pension system. The debate on the sustainability of the pension system is in fact picking up.

In February the unemployment rate decreased slightly, by 0.1%, to 6.5% of the active population. Those figures must be taken in cum grano salis : population is getting older on average. Therefore we have more people getting out of the active segment, than in. Figures then look artificially better. The reality is that there are more retired people and less payments into the pension system. The debate on the sustainability of the pension system is in fact picking up.

Nevertheless, the growth in industrial production generated several new jobs, hopefully on a permanent basis. Unfortunately, they are usually jobs with little or no skills requirements. In any case, we can see a slight upwards pressure on salaries for the lower positions, whereas the white collars compensations are mostly stagnating.

On a broader picture, the Czech job market situation is quite positive when compared with the Eurozone, especially the southern countries. Czechs who don’t work, is usually because of their own choice, not by necessity.

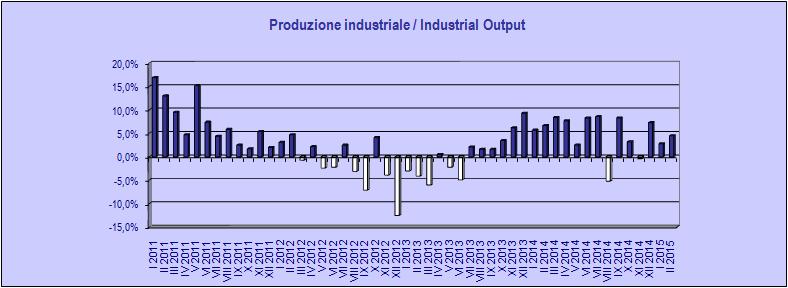

Industrial Production

The Industrial Production was running at full steam in February. It grew by 4.5% on a y-on-y basis. Most importantly, the orders grew by 10% comparing to February 2014. The growth was certainly heavily fostered by the Euro depreciation followed by the de facto pegged Crown. In fact, export sales of strictly industrial products grew by 6.5%, whereas domestic sales continue to be sluggish. In other words, the currency artificial devaluation helps exporters but heavily penalizes families, domestic demand. We lately notice a swift transformation of the Czech Republic into a reservoir of cheap labor for European industry, especially German.

The Industrial Production was running at full steam in February. It grew by 4.5% on a y-on-y basis. Most importantly, the orders grew by 10% comparing to February 2014. The growth was certainly heavily fostered by the Euro depreciation followed by the de facto pegged Crown. In fact, export sales of strictly industrial products grew by 6.5%, whereas domestic sales continue to be sluggish. In other words, the currency artificial devaluation helps exporters but heavily penalizes families, domestic demand. We lately notice a swift transformation of the Czech Republic into a reservoir of cheap labor for European industry, especially German.

As usual, the automotive sector is the engine of the growth, thanks also to a mild surge in car sales in Europe.

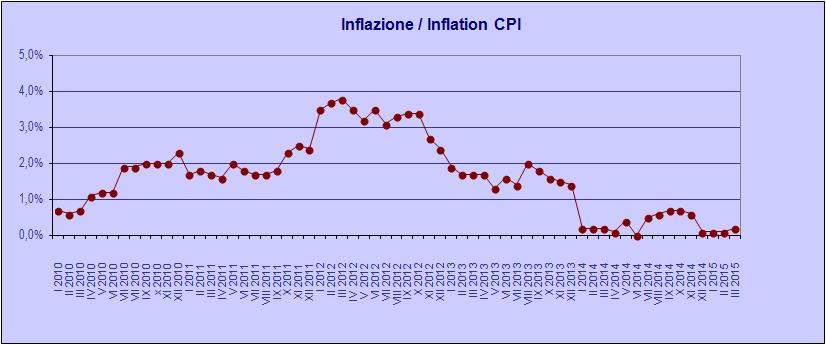

Inflation

The Czech economy during the last several months didn’t seem to be able to get off the de facto deflationary state. Not even the violent depreciation of Euro and Crown has had yet any significant effect on the prices level. In march the CPI recorded an increase by 0.2% on a y-on-y basis, that is effectively a reduction, considering the heavy currency depreciation. The reason is quite simple, actually. Domestic demand is stagnating since many months, not because of prices, but because of lack of disposable income for the families. The artificial increase of the cost of goods imported from non-Eurozone markets, just reduces the volume of goods bought. Furthermore, those being goods most often necessary, such as clothing, gasoline, the pressure to reduce prices goes to domestic products and services, and in fact their prices are actually decreasing. It is quite peculiar that a quick Euro adoption decision is getting more support. Unless the target is to create a large cheap-labour manufacturing area in center-south Europe, to replace cheap Asian good, that is.

The Czech economy during the last several months didn’t seem to be able to get off the de facto deflationary state. Not even the violent depreciation of Euro and Crown has had yet any significant effect on the prices level. In march the CPI recorded an increase by 0.2% on a y-on-y basis, that is effectively a reduction, considering the heavy currency depreciation. The reason is quite simple, actually. Domestic demand is stagnating since many months, not because of prices, but because of lack of disposable income for the families. The artificial increase of the cost of goods imported from non-Eurozone markets, just reduces the volume of goods bought. Furthermore, those being goods most often necessary, such as clothing, gasoline, the pressure to reduce prices goes to domestic products and services, and in fact their prices are actually decreasing. It is quite peculiar that a quick Euro adoption decision is getting more support. Unless the target is to create a large cheap-labour manufacturing area in center-south Europe, to replace cheap Asian good, that is.

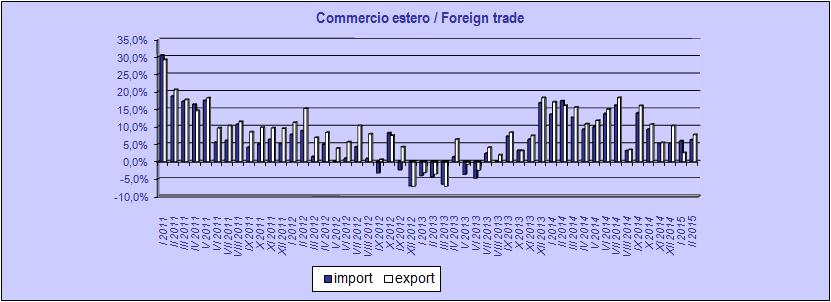

Foreign Trade

The Czech economy proved once again how its export is strong, during the first two months of 2015. The trade balance recorded a 34.7bn CZK surplus – about 1.3bn Eur – at February end, for a y-on-y growth of 14%. In the same period, export grew by 5.8% and import only by 5.2%.

The Czech economy proved once again how its export is strong, during the first two months of 2015. The trade balance recorded a 34.7bn CZK surplus – about 1.3bn Eur – at February end, for a y-on-y growth of 14%. In the same period, export grew by 5.8% and import only by 5.2%.

The almost collapse of oil price certainly helped heavily the trade balance, as well as the pick up in automotive exports. On the other hand the Crown devaluation caused the trade deficit with non-Eurozone countries, mainly Asian, to deteriorate to 36.2bn CZK.

The surplus with the Eurozone countries grew by 15%, to reach 55.8bn CZK – about 2bn Euro. It is once more a clear signal, if any was still needed, of the advisability for the Czech Republic of having its own currency and monetary sovereignty, albeit limited as is lately the case.

by Gianluca Zago