Unemployment

The unemployment level in the Czech Republic is steady since several months. For February, data show a 6.8% rate for the active population, or 8.3% general. The recently implemented new estimation system shows levels lower than the recent past, but it is just an illusion. The solid industrial performance unfortunately didn’t translate into new jobs. Of course, productivity is improving, and therefore Czech goods are more competitive. All great, for exporting. But quite dismal for the job market. The sad truth s that even with a GDP growth higher than 1%, unemployment levels do not structurally improve. Several regions have basically no hope for job creation in the near or medium future. Besides the Prague region, that as usual and for several reasons lives a full-employment situation, large areas of the country seem not to be able to avoid an endemic lack of jobs. A welfare all too generous is not helping, since it grants an acceptable life, albeit lazy, in the less prosperous regions of the Czech Republic.

The outlook for the coming months is quite negative, considering the almost certainty that the economic recovery in Europe will be jobless.

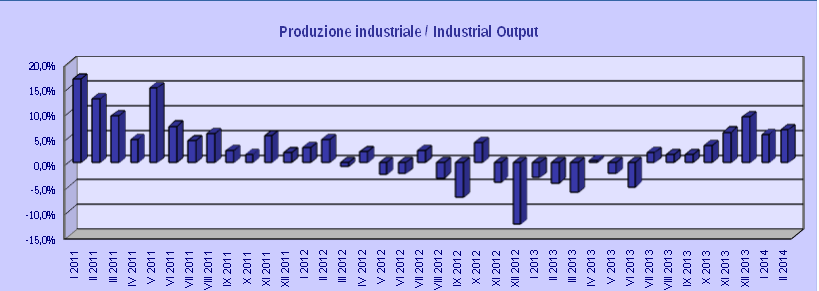

Industrial Output

Very strong industrial performance in February. The output grew by 6.7% at constant prices, y-on-y. Again, the industrial sector proves to be in good shape. But again, as usual, there are no signs of significative new jobs creation. Instead, productivity is improving at a good pace. Most of the industrial production is anyway exported, mainly automotive. That, on the one hand, is of course a positive trait of the Czech industrial sector: it helps solidify the currency and establish strong roots on the international markets. On the other hand, it tends to hide the reality of a very lackluster domestic demand. Which is what eventually generates fiscal revenues to the state, income to local population, and balance in the currency rate. In fact, the Crown tends always to appreciate, pushing the Central bank to find ways to keep it at bay. In any case, the outlook for the coming months is very nice, for the industrial sector. Industrial orders too are in strong growth, by 19% in February. It remains to be seen, how long the Crown can be kept at a competitive level. Considering the massive intervention of the Central Bank at the end of 2013, it is not realistic to hope for another one soon.

Inflation

Really very bad news on the inflation front. Although they are disguised as good ones. The intervention from the Central Bank devaluating the Crown, was supposed to import inflation in the country. At least according to the mainstream economic theories. Unfortunately, that wasn’t the case. The constant decrease in CPI describes a reality much different that the one hoped for. In February, CPI was at 1.1%. From the practical point of view, when under 1%, it means stagflation. Which is the worst cancer to the economic growth, even worse that hyperinflation. Stagflation is the consequence generated by the economic policies of the last 15 years in Europe. At the moment, the only tool available to avoid a dramatic stagflating environment, and therefore more recession, is to create inflation through massive QE. That is first and foremost a political choice, before being an economic one. The actual government seems to adhere inconditionally to BCE policy, that is a “no-inflation” mission, no matter what the consequences. We can only hope that the Czech Central Bank, being still an independent institution, will be able to implement at least some minimalistic measures to protect the local economy, familes, consumers.

Foreign Trade

Again in February, strong positive trade balance. Slightly lower y-on-y, but data are quite influenced by the exchange rate, and by the massive influx of Asian imports prior to the traditional factory freeze for the long Chinese New Year festivities. The surplus recorded in February was by 13.6bn Crowns. Very large surplus against the EU area, by 50bn Crowns, growing by 20% y-on-y. And as usual, a very heavy deficit against Asian countries, and Russia. Both import and export grew strongly, by 16.1% and 17.4% in Crowns, or by 7.8% and 9.0% in EUR. It keeps baffling us, all the more after looking at the latest data, how there still is quite a large chunk of experts and badly informed citizens who look forward to the adoption of the Euro currency. They clearly do not realize that the positive trade balance, especially for a small country such is the Czech Rep., is due almost solely to independent money, and to the managing of the national debt through a local currency.

by Gianluca Zago