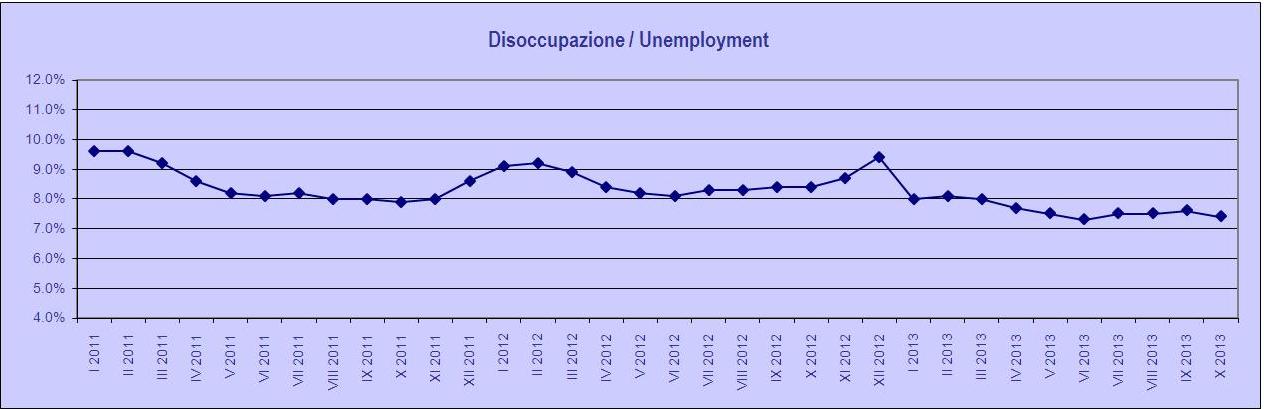

Unemployment

The unemployment level keeps steady, slightly growing at 7.6%. Once the seasonal positive effect subsided, now the hopes lay on the EU recovery which determines an increase in industrial production destined to export. Unfortunately, there are strong signals for a jobless recovery, though. Furthermore, in September there was an increase in the average wage for the industrial sector, without an improvement in the employment numbers, which is quite worrisome. Prague region enjoys, as usual, the much envied almost-zero unemployment. That is not the case of the country’s weakest regions, in the north and south-east, where there are no signs of jobs growth. The main reasons are the general unwillingness of the population to relocate, and too generous subsidies for the unemployed workforce.

Industrial Output

The industrial sector keeps showing a good performance. The industrial output in September grew by a 7.1% y-on-y, or 2.0% adjusted by actual working days. Unofficial data for October indicate that the trend is progressing, and expectations for the year’s end are very good. Especially interesting is the strong growth of forward orders, by a stunning 16% in September. Furthermore the EU area ongoing recovery albeit mild, gives a positive outlook for the Czech industry, being EU its main export area.

It rests to be seen the actual effect of the de facto devaluation of the Crown, determined by the Central Bank. Most probably we shall see an increase of the industrial orders from abroad, whereas the domestic demand is already taking a hit: during the next months shall be apparent which factor will be stronger.

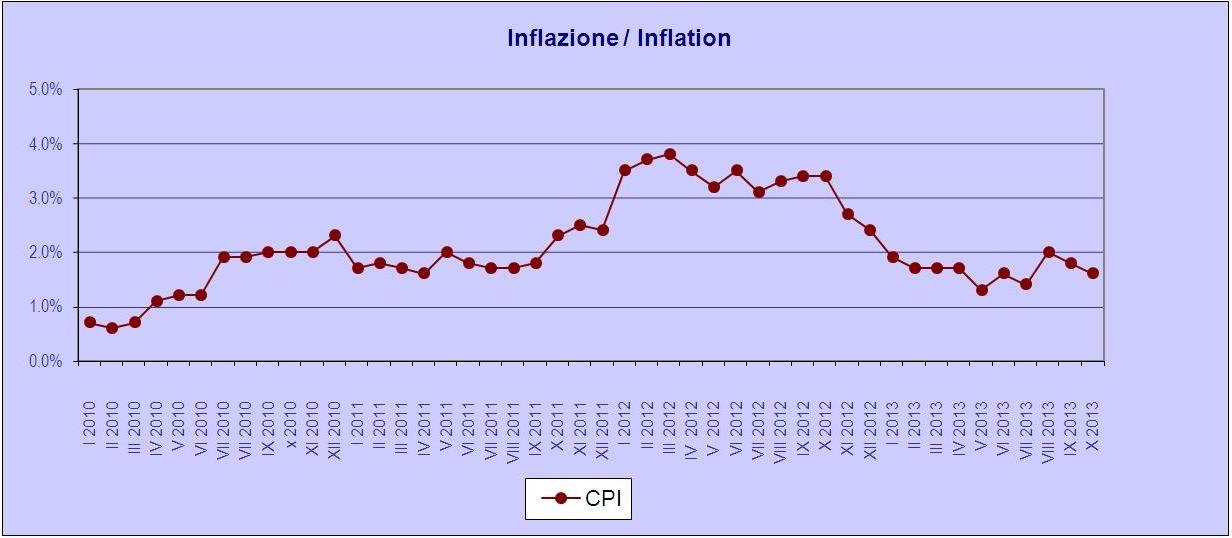

Inflation

The CPI index of price inflation seems to be eventually growing a bit, and is now at 1.6%. The dreaded stagflation danger seems to be behind us. As we all know, it is one of the worst danger to the economy.

In fact, a low inflation is not necessarily a positive sign, when the domestic demand is very weak and there are almost no investments into industrial production. We saw in the last few years, that the drop in domestic demand wasn’t due to inflation, but to erosion of income and to deterioration of the job market.

The Crown devaluation forced by the Central Bank shall determine among the various effects, also a pick up in price inflation. That would most probably weaken even more the domestic demand, but help industrial production therefore hopefully generating new job opportunities.

Foreign trade

As usual, the trade balance was in positive territory also in September, by a nice 35bn Crowns, growing from last year by about 5bn. Exports are back in spades again, after a temporary step back, by 8.2% with a nice outlook, considering the pick up in industrial production orders and the ongoing recovery of the EU area. Imports grew by 7.2%. We must note that the constantly positive trade balance is the key for the relatively healthy state of the Czech economy. That actually is the definite argument against the Euro currency adoption. Luckily, that moment seems quite far ahead in time, and hopefully it will never be reached.

Recently the playing field has been shaken by the Crown devaluation towards the Euro. The first projections are for a positive net effect for the trade balance, thanks to the increase of exports and the inevitable compression of the domestic demand.

by Gianluca Zago